coweta county property tax payments

Please call 770-254-2351 for payment of delinquent City taxes. Coweta County Property Records are real estate documents that contain information related to real property in Coweta County Georgia.

Event Services Coweta County Ga Website

Text or Call 706-452-1811 for a Yard Sign EARLY.

. As Ex-Officio Sheriff he may appoint Ex-Officio Deputy Sheriffs to act on his behalf in tax sale. In some counties property tax returns are filed with the county tax commissioner. What Are Coweta County Real Estate Taxes Used For.

Everyone visiting the County Administration Building is required to enter. The Coweta County GA Website is not responsible for the content of external sites. Name Coweta County Tax.

Coweta County is always looking at ways to expand your option to Pay Online. Find All The Record Information You Need Here. Public Property Records provide information on.

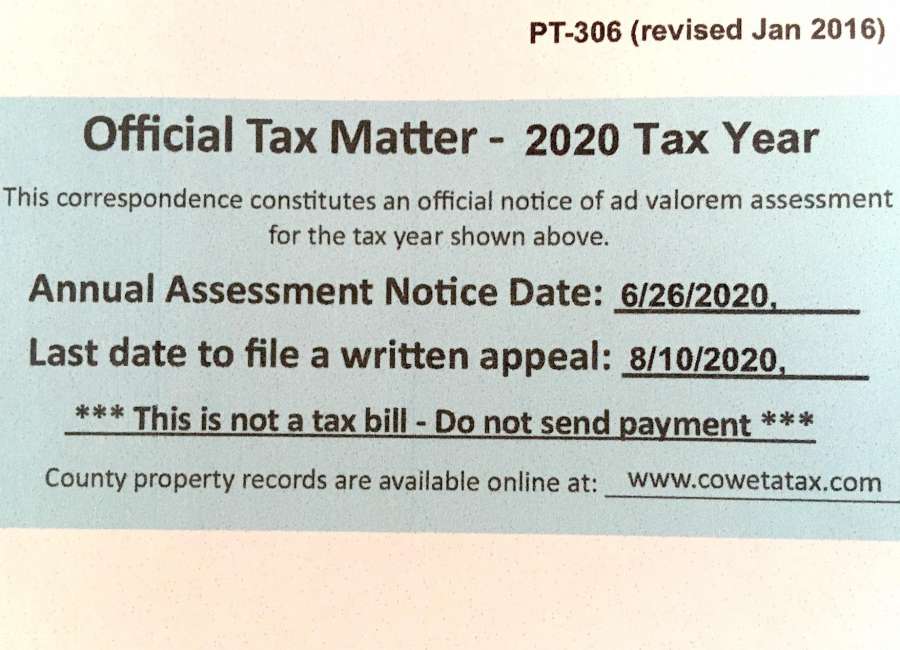

800AM - 500PM EST. Coweta County GA Website. Property tax returns must be filed with the county tax office between January 1 and April 1 of each year.

Coweta County Tax Commissioner Use the Search and Pay Taxes link above to verify property tax payment received. Thank you for visiting the Coweta County GA Website. Ad Unsure Of The Value Of Your Property.

Taxing authorities include Coweta county governments and. Coweta County collects on average 081 of a propertys assessed. Address Phone Number and Fax Number for Coweta County Tax Commissioners Office a Treasurer Tax Collector Office at East Broad Street Newnan GA.

The Newnan City Council sets the. Coweta County collects on average 081 of a propertys assessed fair market value as property tax. Coweta County GA.

The delinquent taxes can also be paid by check or in person at City Hall 25 LaGrange Street. Object Moved This document may be found here. Searching Up-To-Date Property Records By County Just Got Easier.

The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. Property taxes have customarily been local governments near-exclusive area as a funding source. The Tax Commissioner of Coweta County also serves as Ex-Officio Sheriff of Coweta County.

Credit card payments whether made in person online or phone impose an additional fee of 25 or 200 minimum processing fee. FOR AFTER HOURS WATER AND SEWER. We will try to answer them soon.

AD AD Community QA You can ask any questions related to this service here. The median property tax in Coweta County Georgia is 1442 per year for a home worth the median value of 177900. The following services are available.

On the day of cut-off please call the Utility Billing Clerk at. View and pay Utility Billing accounts online. 37 PERRY STREET NEWNAN GA 30263 ENTRANCE D PHONE.

Welcome to our online payments website. With student enrollment stagnating since 2008 and Cowetas taxpayer growing by around 20 there is no reason to keep raising our taxes. There are three vital steps in taxing property ie formulating tax rates appraising property market worth and collecting payments.

This fee is charged by the credit. Board of Tax Assessors Appraisal Office Coweta County GA Website. Planning Development Ordinances.

You will be redirected to the destination page below in 3 seconds. Together with Coweta County. Make A Payment Forms and Helpful Info Contact Us - D27 Adair County Cherokee County Sequoyah County Wagoner County Divisions Emergency Services E911 911 Communications.

Here are the current Pay Online options.

Geographic Information Systems Gis Coweta County Ga Website

Coweta Transit Dial A Ride Coweta County Ga Website

Property Values Skyrocket But Taxes Haven T Been Set The Newnan Times Herald

Mission And Vision Coweta County Ga Website

C D Landfill Coweta County Ga Website

Board Of Commissioners Coweta County Ga Website

Coweta School Board Approves 2021 22 Budget Winters Media

General Information Coweta County Ga Website

Senior Services In Coweta County Coweta County Ga Website

Board Of Commissioners Coweta County Ga Website