child tax credit september 2021 direct deposit

From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. For a person or couple to claim one or.

Childctc The Child Tax Credit The White House

Income limits and other criteria may also be found in the PTC rebate application booklet for the application year.

. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of August as direct deposits begin posting in bank accounts and checks arrive in mailboxes. If the payment is sent by direct deposit. By Christine Tran 2021 Get It Back Campaign Intern.

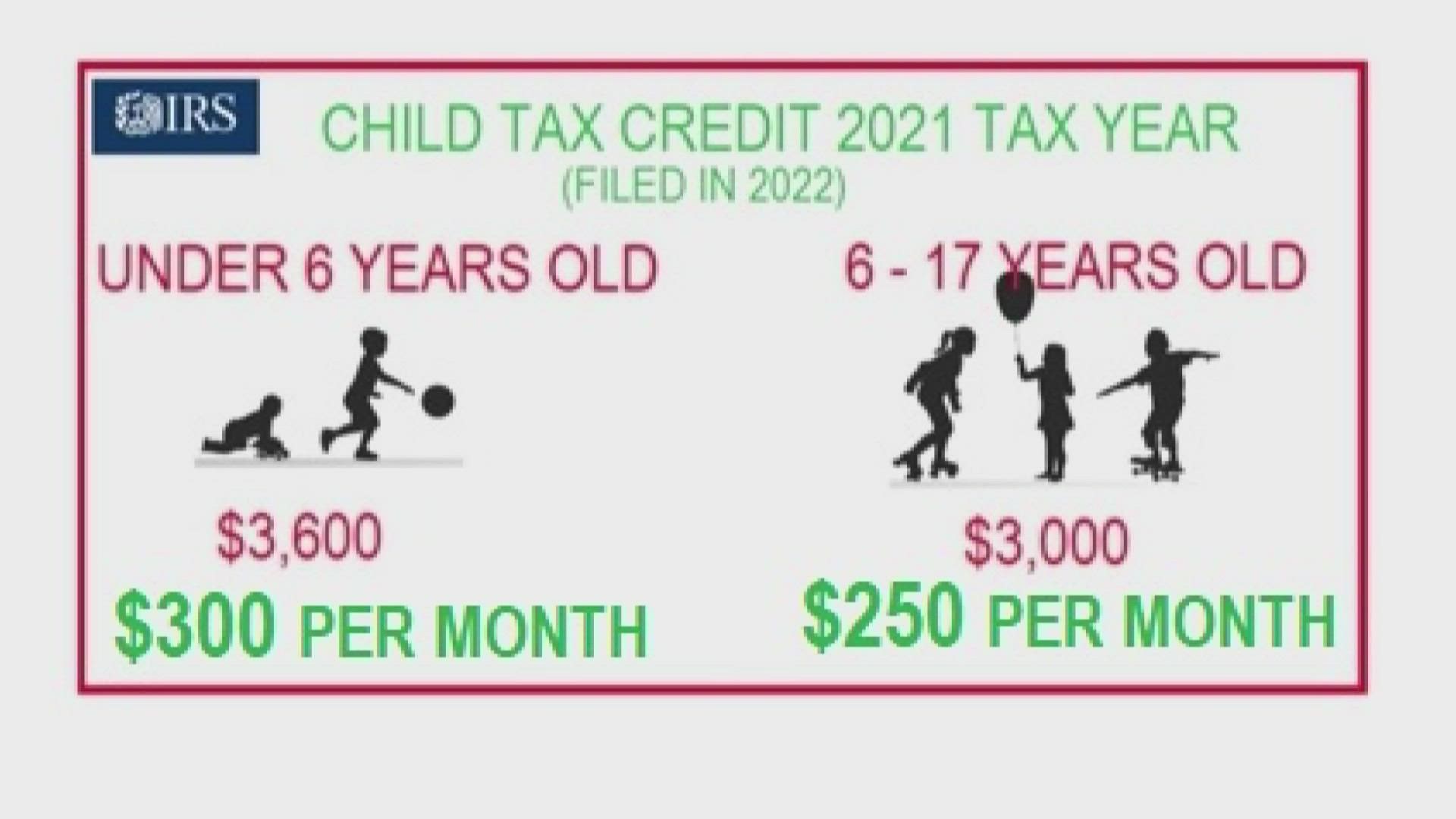

IR-2021-169 August 13 2021. The advance child tax credit payments were early payments of up to 50 of the estimated child tax credit that taxpayers may properly claim on their 2021 returns. You are not claimed as a dependent on any other persons federal income tax return.

You can claim the. Credit Union 1 CU1 has a 500 checking account promotion with qualifying direct deposits. File a federal return to claim your child tax credit.

Available to both new and existing customers who havent set up direct deposit yet. Simple or complex always free. The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children.

The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start. Based in Illinois CU1 membership is open nationwide through membership in the Credit Union 1 Educational Development Association one-time 5 CU1EDA fee additional one-time. Advance child tax credit payments.

4 weeks if the payment was mailed by check to a standard address. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Low income adults with no children are eligible.

A guide for divorced unmarried separated and non-custodial parents and guardians on all things Child Tax Credit and advance payments. The current tax season has been as bumpy as the last with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch-up payments for stimulus checks RRC and advance child tax credit payments. The value of a tax credit depends on the nature of the credit.

A tax credit is an amount of money that taxpayers are permitted to subtract from taxes owed to their government. September 14 2021. You were at least 65 years old by December 31 2021 or are a surviving spouse at least 58 years old by December 31 2021.

The amount of EITC benefit depends on a recipients income and number of children.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Get My Payment Irs Portal For Stimulus Check Direct Deposit Money

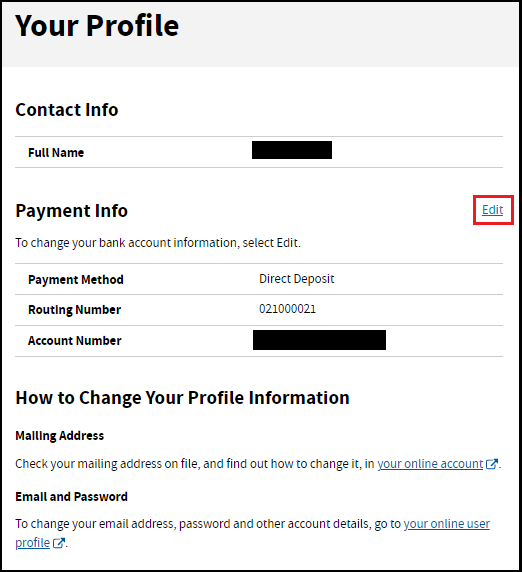

Child Tax Credit Portal Get Your Direct Deposit Gobankingrates

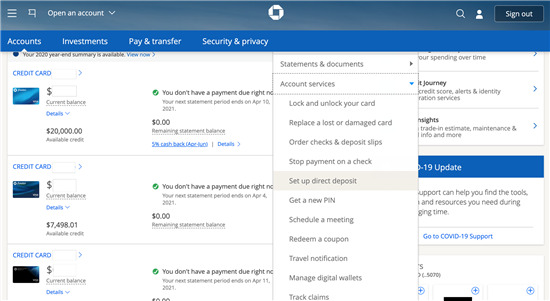

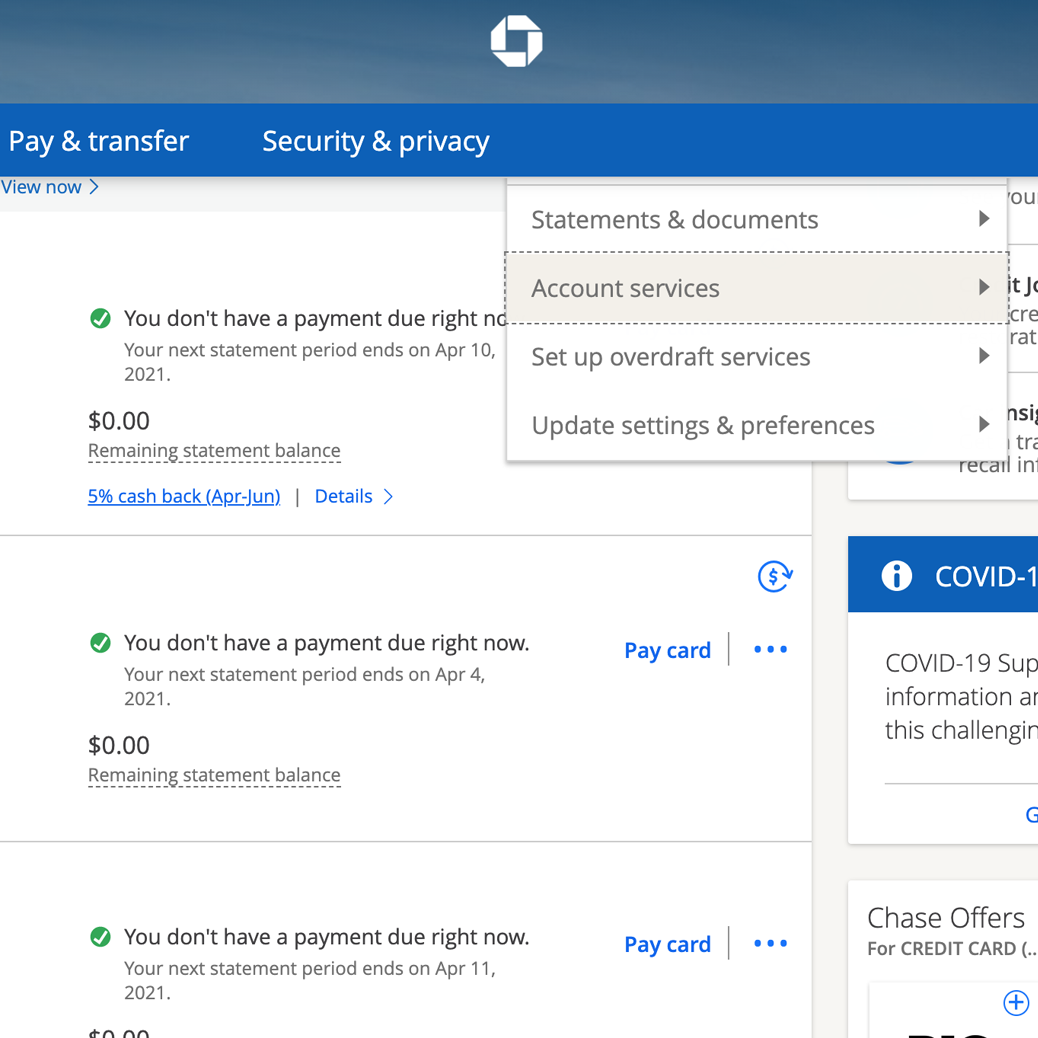

How To Set Up Direct Deposit With Chase Fast

New Child Tax Credit Monthly Advance Payments

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Set Up Direct Deposit With Chase Fast

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Abc10 Com

Tax Tip Returning A Refund Eip Or Advance Payment Of The Ctc Tas

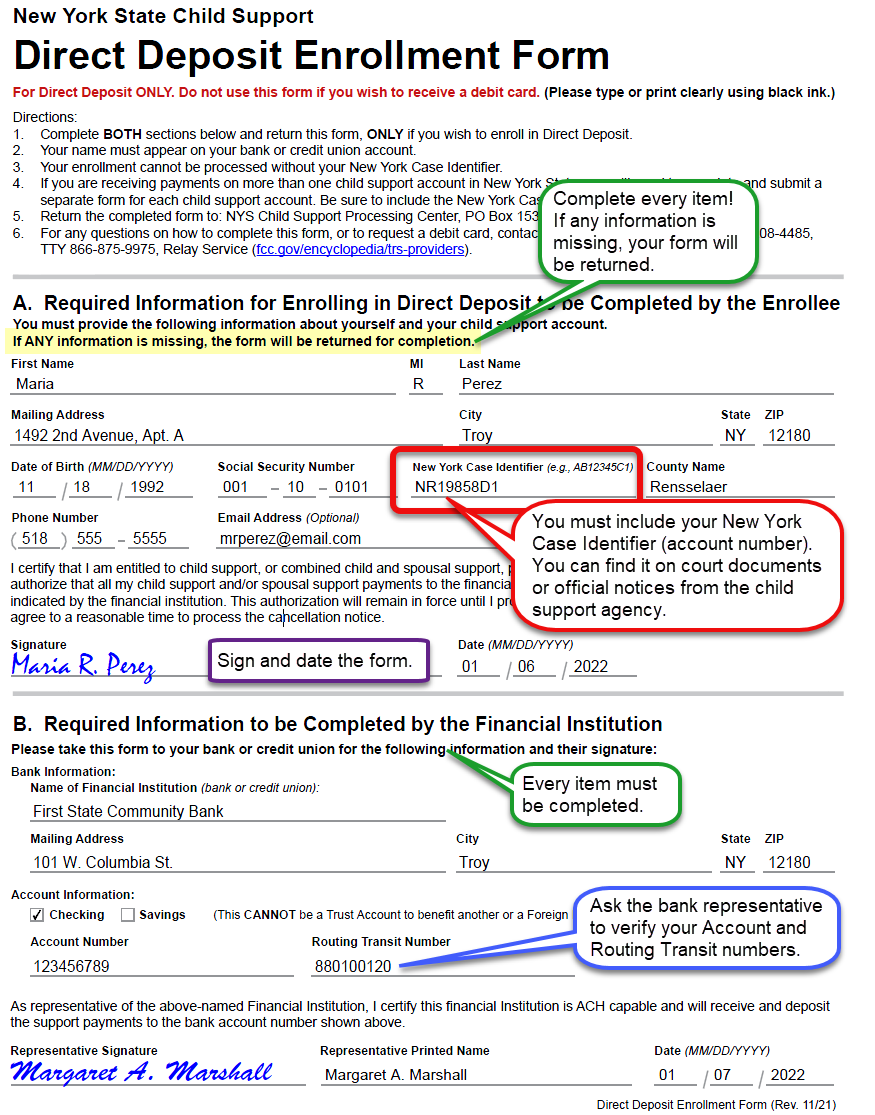

Ach Deposit Authorization Form Template Inspirational 10 Securitas Direct Deposit Form Electronic Forms Deposit Directions